Review Article: IIBF X Taxmann’s Inclusive Banking Through Business Correspondents (Advanced Course)

Introduction

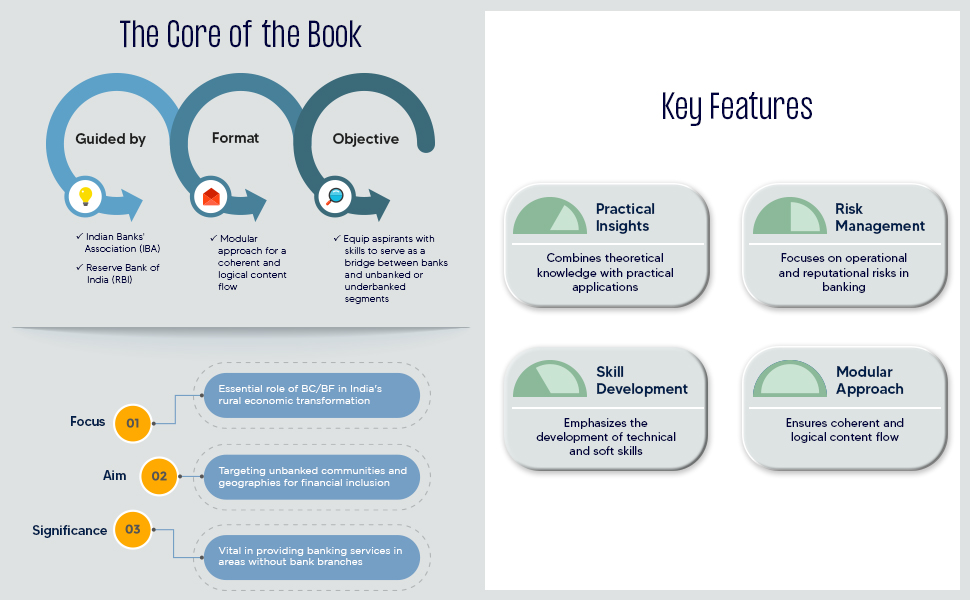

In the rapidly evolving landscape of banking and finance, the role of Business Correspondents (BCs) has become increasingly pivotal, especially in promoting financial inclusion in underserved regions. The Indian Institute of Banking and Finance (IIBF) has collaborated with Taxmann to develop an advanced course titled "Inclusive Banking Through Business Correspondents." This course serves as an essential resource for individuals aspiring to serve as full-fledged BCs and effectively manage customer service points. This review critically evaluates the course’s relevance, content, structure, and practical implications.

Course Overview

The "Inclusive Banking Through Business Correspondents (Advanced Course)" is meticulously designed to equip learners with the requisite skills, knowledge, and competencies required to thrive as BCs. The course encompasses a wide range of topics, including the regulatory framework, operational strategies, customer relationship management, and technology integration in banking.

Content and Structure

-

Comprehensive Curriculum:

The course content is extensive, covering fundamental areas such as the role of BCs within the banking ecosystem, financial literacy, product awareness, and customer service excellence. This holistic approach ensures that participants gain a deep understanding of inclusive banking practices. -

Regulatory Framework:

A significant feature of the course is its in-depth exploration of the regulatory guidelines governing BC operations in India. Understanding the legal framework is crucial for BCs as it helps mitigate risks and ensures compliance with banking norms. -

Practical Application:

The curriculum emphasizes real-world scenarios through case studies and role-playing exercises, allowing participants to apply theoretical concepts in practical situations. This hands-on approach is instrumental in preparing BCs for the challenges they may face in the field. - Technological Integration:

With the advent of digital banking, the course delves into how technology can be leveraged to enhance customer service efficiency. The incorporation of digital tools in banking processes and customer engagement is particularly relevant in today’s tech-driven environment.

Target Audience

The course targets a diverse group, including aspiring BCs, existing customer service representatives, and banking professionals seeking to enhance their understanding of inclusive banking practices. Given the growing emphasis on financial inclusion, the course is beneficial for individuals aiming to make a meaningful impact in their communities.

Learning Outcomes

-

Enhanced Knowledge Base:

Participants will leave the course with a well-rounded understanding of banking products, services, and operational standards applicable in their roles as BCs. -

Skill Development:

The curriculum aims to cultivate essential skills such as customer relationship management, problem-solving, and financial advisory, all of which are vital for effective BC operations. - Empowerment of Communities:

By training individuals to act as BCs, the course contributes significantly to empowering communities through accessible financial services. This aligns with the national objective of achieving financial inclusion for all.

Conclusion

The IIBF X Taxmann’s "Inclusive Banking Through Business Correspondents (Advanced Course)" stands out as a critical resource for individuals looking to navigate the challenging yet rewarding landscape of inclusive banking. With its comprehensive curriculum, practical insights, and requisite focus on regulatory compliance, the course equips participants with the tools needed to excel as BCs.

As the demand for inclusive banking solutions continues to rise, this advanced course emerges not only as an educational resource but also as a catalyst for positive change in the banking sector. Its commitment to enhancing financial literacy and accessibility makes it an invaluable asset for aspiring BCs, ultimately contributing to broader societal goals of economic development and inclusivity.

Recommendation

For anyone aspiring to become a Business Correspondent or enhance their understanding of the nuances of inclusive banking, enrolling in this course is highly recommended. It is not merely a learning experience, but a step towards being part of a larger movement aimed at bringing financial services to the underserved and ensuring that no one is left behind in the journey towards a financially inclusive society.

Price: ₹545 - ₹504.00

(as of Mar 05, 2025 13:41:48 UTC – Details)

This comprehensive guide is essential for individuals aspiring to become Business Correspondents (BCs) or Business Facilitators (BFs) in India’s evolving financial landscape. This guide is designed to equip candidates with the knowledge and skills needed to effectively serve as a bridge between banks and the unbanked or underbanked segments of society, thereby contributing significantly to the overall economic development of India.

This book has been developed under the guidance of the Indian Banks’ Association (IBA) and the Reserve Bank of India (RBI). It addresses the operational and reputational risks banks face when engaging BCs and underscores the need for skill development in these roles. It adopts a modular approach, ensuring a coherent and logical flow of content, and the content includes a mixture of theoretical knowledge and practical insights, which is as follows: General BankingFinancial Inclusion and Role of Business CorrespondentsTechnical SkillsSoft Skills and Behavioural Aspects

It is an invaluable resource for practising bankers and institutions seeking a deeper understanding of financial inclusion, the BC/BF model, and the certification aspirants.The Present Publication is the 2024 Edition, revised and updated by Mr K.S. Padamnabhan | Retd. CGM – NABARD. Taxmann exclusively publishes this book for the Indian Institute of Banking and Finance with the following noteworthy features: [Structure of Indian Banking and Types of Banks] This section discusses the Indian banking system’s framework, exploring the variety of banks and their functions alongside recent trends in banking [Banking Services and Operations] It discusses various deposit schemes, account opening procedures, KYC mechanisms, and banking operations. It also includes chapters on accounting, finance, and principles of sound lending, with a special focus on retail lending [Risk Management and Regulatory Frameworks] The book addresses asset classification, methods of recovery, and the integrated ombudsman scheme, emphasizing the importance of risk and fraud management in banking operations [Financial Inclusion and the Role of BC/BF] This critical section discusses financial inclusion, detailing the BC/BF model, the need for such a model, and the roles and responsibilities involved. It also sheds light on government schemes promoting financial inclusion. [Technical Skills for Business Correspondents] This section makes the reader understand how to handle micro ATMs, biometric devices, basic connectivity issues, digital banking products, and recent developments in digital banking [Soft Skills and Behavioural Aspects] The book underlines the importance of soft skills for business correspondents, including relationship building, negotiation skills, dealing with various types of customers, and strategies for loan recovery.

The detailed contents of this book are as follows: Module A – General Banking

o Structure of Indian Banking and Types of Banks

§ Overview of the Indian banking system

§ Functions and regulation of banks in India

§ Recent trends in banking

o Various Deposit Schemes and Other Services

§ Details on different types of deposits

§ Introduction to the DICGC and RBI Retail Direct Scheme

§ Discussion on remittances

o Account Opening, On-boarding Process, KYC Mechanism, and Operations

§ Procedures for opening bank accounts

§ Importance of KYC in banking operations

§ Guidelines for account operations and closure

o Accounting, Finance & Operations

§ Basics of accounting and book maintenance

§ Understanding of finance and bank operations

o Principles of Sound Lending

§ Discussion on lending principles

§ Relationship between interest spread and profitability

o Loans and Advances with a Special Focus on Retail Lending

§ Various types of loans, including retail, education, and housing loans

§ Introduction to credit cards and MSME loans

o Asset Classification and Methods of Recovery

§ Definition and classification of Non-Performing Assets (NPAs)

§ Various methods for loan recovery

o Grievance Redressal Mechanism in Banks and Integrated Ombudsman Scheme

§ Understanding customer grievances and redressal mechanisms

§ Introduction to the Integrated Ombudsman Scheme

o Overview of the Financial Market

§ Examination of the Indian financial market and its regulators.

§ Deposit schemes and services

§ Account opening, KYC processes, and banking operations

§ Principles of sound lending, loans, advances, and asset classification

§ Grievance redressal mechanisms in bankingModule B – Financial Inclusion and Role of Business Correspondents

o Financial Inclusion

§ Concept and need for financial inclusion

§ Roles and Responsibilities of Business Correspondents/Facilitators

o Financial Education and Financial Counselling

§ Importance of financial education

§ Roles of financial counsellors in education and cross-selling

o Government Schemes for Promoting Financial Inclusion

§ Overview of schemes like PMJDY, PMJJBY, and PMSBY

§ Discussion on the National Strategy for Financial InclusionModule C – Technical Skills

o Basic Technical Skills

§ IT skills for financial inclusion using the BC Model

§ Technology for low-cost financial inclusion

o Digital Banking Products

§ Need and types of digital banking products

§ Introduction to mobile banking, internet banking, and ATMs

o Recent Developments in Digital Banking

§ Developments like CBDC and account aggregatorsModule D – Soft Skills and Behavioural Aspects

o Basic Skill Requirements for Business Correspondents

§ Difference between soft and hard skills

§ Soft skills for building relationships

o Dealing with Various Types of Customers & Strategies for Recovery of Loans

§ Techniques for dealing with different customer types

§ Strategies for Effective Loan Recovery

From the Publisher

Publisher : Taxmann Publications Private Limited (16 January 2024); Taxmann Publications Private Limited, 59/32, New Rohtak Road, New Delhi-110005, Email Id: sales@taxmann.com, Phone Number: 011-45562222

Language : English

Paperback : 350 pages

ISBN-10 : 9357786635

ISBN-13 : 978-9357786638

Item Weight : 415 g

Dimensions : 27.94 x 25.4 x 2.54 cm

Country of Origin : India

Net Quantity : 1 Count

Packer : Taxmann Publications Private Limited, 59/32, New Rohtak Road, New Delhi-110005, Email Id: sales@taxmann.com, Phone Number: 011-45562222

Generic Name : IIBF 2024 Books, Indian Institute of Banking & Finance Books, IIBF Course Material, Banking & Finance Books, Banking Professionals Books, IIBF Certification Examination Books, FEMA Banking & NBFC, FEMA Banking & NBFC Commentary, FEMA, Banking Books